AI Stock Trading Bot For Beginners (No Code)

Stepping into the world of stock trading can feel like trying to pilot a spaceship without a manual—especially when you hear things like “algorithms,” “quantitative signals,” or “neural networks.” But what if I told you that you can use AI-powered trading bots—without writing a single line of code—and still feel like you’re flying the thing?

Whether you’re a total beginner or someone who just doesn’t fancy spreadsheets and scripts, there’s a new breed of AI trading tools designed exactly for people like us: no coders, curious minds, and casual traders.

Let’s break down what this whole AI stock trading bot thing is about, how it can help you, and which ones are actually worth your attention.

Why AI Trading Bots Are a Big Deal (Especially for Beginners)

Stock markets are emotional. Ironically, the smartest trading decisions come from not being emotional. That’s where AI steps in. These bots analyse thousands of data points faster than your human brain can blink—price trends, volume changes, news sentiment, insider activity—all processed without the fear, greed, or guesswork.

But here’s the magic: no-code AI trading bots let you tap into this smart tech without having to learn Python or set up your own server. You just plug in your preferences, tweak a few sliders, and let the algorithm do the heavy lifting. Think of it as hiring a robo-analyst who works 24/7 and never asks for coffee breaks.

⬇️ See the top AI trading bots

What to Look For in a No-Code AI Trading Bot

Let’s not get scammed by slick interfaces. Here’s what you want:

- Pre-built Strategies: Are there templates you can use out of the box?

- Backtesting: Can you test strategies on historical data before risking real money?

- Transparency: Does the platform explain how its AI works, or is it just black-box magic?

- Integration: Does it connect to your broker (Robinhood, Coinbase, Binance, etc.)?

- User Interface: Can your grandma use it? If not, rethink.

Common Use Cases (and Real-Life Vibes)

- You’re a beginner who wants to “autopilot” stock trading while learning.

- You work full-time and can’t stare at charts all day.

- You’re tired of meme stocks and want something data-driven.

- You want diversification between crypto, stocks, and forex.

If you’re nodding along to any of these, the bots we’re about to discuss might just be your new trading BFFs.

Table of Contents – Best AI Stock Trading Bots (No Code)

What is it?

Aterna AI is like the thinking trader’s AI assistant. It’s built for those who want AI that feels less robotic and more intuitive—like a trading mentor that speaks your language.

Key Features

- Strategy generation based on conversational input

- Custom portfolio risk profiles

- Trade explanation layer—why it’s taking action

- Long/short equity-focused with occasional crypto suggestions

Use Cases

Perfect for people who want to understand why a trade is made, not just follow blindly. If you’re building confidence and want to grow with your bot, Aterna’s “explainability” gives you peace of mind.

My Verdict

It’s a bit like having a clever friend whispering market tips in your ear. Huge win if you’re both curious and cautious.

What is it?

Tickeron scans markets for technical patterns, insider activity, and news sentiment—then serves up trade ideas on a silver platter.

Key Features

- AI pattern search engine (hello, flags, triangles, wedges)

- Backtested trade signals

- Prediction Confidence Ratings (nice touch!)

- Marketplace for pro strategies

Use Cases

Great for folks who want to learn technical analysis along the way. You can see how patterns lead to trades and tweak them for your own needs.

My Verdict

Visual learners, this one’s for you. The prediction graphs are borderline addictive.

What is it?

Think of Intellectia as a data geek that loves you. It focuses heavily on AI-powered market forecasts, giving you probabilities rather than vague “buy” suggestions.

Key Features

- Predictive models on equities and ETFs

- Dynamic signal generation

- Portfolio rebalance tools

- User-friendly dashboards

Use Cases

Ideal for strategy nerds who don’t want to code but still love forecasting models and risk assessments.

My Verdict

It’s the AI bot for data romantics—if you love patterns, charts, and numbers, Intellectia will flirt with your inner quant.

What is it?

Not just a charting platform—TradingView now integrates AI-based signal bots and third-party scripts you can use or clone.

Key Features

- Massive community of script-sharing traders

- Pine Script editor (optional)

- Alerts, signal bots, and integrations with brokers

- Beautiful UI that makes you feel smart even when you’re not

Use Cases

Perfect for DIY traders who want full control but also the option to copy smarter people. No-code users can use shared strategies without touching code.

My Verdict

It’s like Reddit + Bloomberg + Excel on steroids. If you like to learn socially, go here.

What is it?

Coinrule is a Lego kit for trading strategies. “If this, then that” but for stocks and crypto.

Key Features

- Drag-and-drop rule builder

- Pre-built templates for momentum, RSI, MA crossover

- Backtesting engine

- Connects to brokers like Binance, Coinbase, and some stock APIs

Use Cases

For tinkerers who like control but hate code. You’ll love how easy it is to test “what if” scenarios.

My Verdict

Honestly? One of the most satisfying UIs out there. It’s the AI bot for creative thinkers.

What is it?

Kavout uses machine learning and big data to rank stocks using its “Kai Score”—a blend of fundamentals, momentum, and price action.

Key Features

- Kai Score for equities

- Portfolio modeling tools

- Data-driven insights with minimal fluff

- Integrates with hedge fund-level data

Use Cases

You want rankings, not rules. Just tell me what the top stocks are, please.

My Verdict

If you’re a “just tell me the best” kind of trader, Kavout hits that sweet spot.

What is it?

TradeIdeas is like caffeine for traders. It’s rapid, loud, and smart. Their AI, “Holly,” scans live markets and delivers strategies.

Key Features

- Real-time idea scanner

- AI models that test thousands of strategies

- Brokerage integration

- Paper trading mode

Use Cases

Made for fast movers—day traders, scalpers, and market junkies.

My Verdict

If you get a rush from tick-by-tick action, this one’s your spirit bot.

What is it?

Originally a crypto bot, TradeSanta now supports a few traditional assets and offers easy automation.

Key Features

- Grid and DCA strategies

- Multi-exchange support

- Simple interface

- Marketplace of bot templates

Use Cases

Crypto-first traders who want to try their hand at stocks without jumping to a new platform.

My Verdict

Slick and simple. Like if Coinbase made a bot—user-friendly to the bone.

What is it?

Bitsgap connects multiple exchanges, giving you a single control panel for all your trading bots.

Key Features

- Unified dashboard

- AI-powered bots (grid, arbitrage)

- Backtesting

- Supports crypto, forex, and indices

Use Cases

For people juggling accounts on multiple exchanges—great for both crypto and traditional traders.

My Verdict

If your tabs are always overflowing, you need Bitsgap’s all-in-one view.

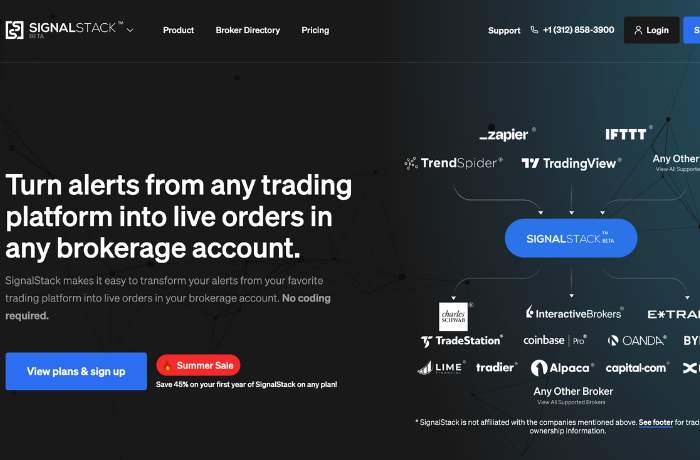

What is it?

Signal Stack isn’t a bot itself—but it lets you automate signals from your favourite tools (like newsletters, TradingView alerts, etc.).

Key Features

- Converts alerts into trades automatically

- Works with brokers and exchanges

- No code setup

- Webhook-based logic

Use Cases

Perfect for newsletter junkies or community signal followers—you get alerts, and Signal Stack places the trades for you.

My Verdict

It’s automation glue. Brilliant if you already know what you want to trade but don’t want to babysit your screen.

Final Thoughts & Top 3 Picks

After diving headfirst into these platforms, here’s how I’d sum it up:

Best Overall – Coinrule

The perfect mix of power and ease-of-use. You can build, test, and launch strategies without feeling like you’re debugging a nuclear reactor.

Best for Learning – Aterna AI

If you want to understand what’s happening and grow your skills, Aterna makes AI explainable—and that’s worth gold for beginners.

Best for Fast-Movers – TradeIdeas

For the adrenaline traders, nothing comes close. Real-time scans, AI-driven picks, and momentum alerts that keep your pulse racing.