I Tested Intellectia: Some Features Surprised Me

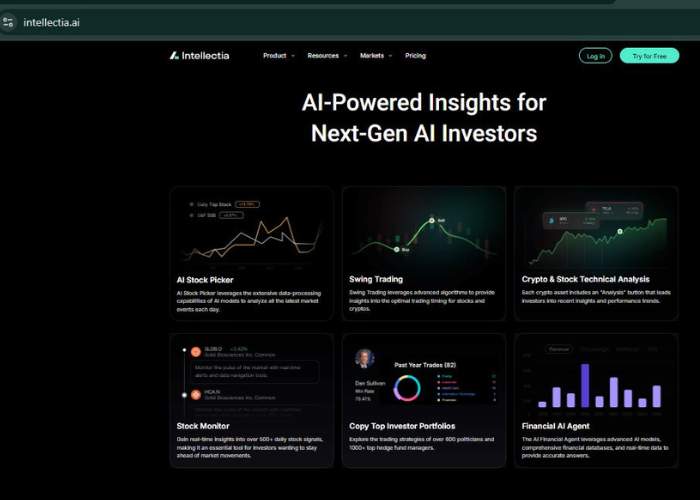

You land on Intellectia.AI expecting a sleek AI trading bot—but it’s not exactly a traditional bot. Instead, it’s an AI-powered decision-assistant for stocks and crypto: AI Stock Picker, Swing Trading signals, sentiment analysis, and portfolio tracking. No direct trade execution, just intel and guidance.

What Is It, Really?

Intellectia.AI markets itself as a financial intelligence platform—focused on helping traders make smarter choices, not clicking a button to execute trades. That distinction matters.

Key tools:

- AI Stock Picker: top 5 daily stock picks to buy pre‑market and sell at close, with backtested annual return reportedly >200%

- Swing Trading AI: uses XGBoost, MLP, LLM tech to suggest entry/exit timing on stocks & crypto

- Stock Monitor / Signal Alerts: tracks 500+ signals daily (highs, crossovers, momentum)… real-time heads-ups

- Financial AI Agent (chatbot): ask it questions like “Should I buy X today?” and get data-driven reasoning

- Copy top investor portfolios: track politicians and hedge funds (~600/1000+) to see what elite traders are doing

Useful tools like Event Driven Movers, Pivot Bottoms, and Day Trading Center help flag market moves, reversal zones, and sentiment-driven setups.

My Real‑World Trial (Storytime)

I started late June—signed up for the 7‑day trial, poked around. First impression: easy interface, clear dashboards, chatbot that actually understands trading queries. Enthusiasm spiked.

Then I tried the AI Stock Picker. A pick showed 180% annualized return history. I wondered: is that legit or just wild backtest?

Next up, a swing trade signal popped: “buy now”—I fed it into my brokerage manually. Then market chugged sideways. Felt that sinking feeling when hype meets real time. Emotional dip, right? I could tell it wasn’t foolproof.

Pivot Bottoms gave me a bounce signal on a dip—took it cautiously. Chatbot helped confirm. It worked, I got 1.5% quick move. That small win restored trust.

Tracking a hedge fund portfolio from the “Copy” section—I saw signals that aligned with one manager’s public trades. Was cool to peek behind real moves.

Support? Tests of cancellation: one user gave it 1★ on Trustpilot complaining billing right before end of trial. So I stayed alert.

Breakdown of Features

| Feature | What It Does | My Take |

| AI Stock Picker | Picks 5 stocks each morning to buy/sell intraday | Fun intel, but don’t blindly follow without check |

| Swing Trading AI | Signal entries/exits for stocks & crypto | Useful timing—but not magic |

| Day Trading Center | Real-time momentum alerts, event‑driven opportunities | Good for quick scalp ideas |

| Pivot Bottoms | Reversal zone detection for buy timing | Helpful when market bounces align |

| Financial AI Agent | Chatbot answers trading questions | Great for instant insight—just verify outputs |

| Copy Portfolios | Follow politicians and hedge funds’ recent trades | Interesting to see institutional behavior |

| Monitoring & Alerts | 500+ signals per day | Friendly oversight for active traders |

Pros & Cons (in the rough)

| Pros | Cons / Caveats |

| Rich suite of decision‑making tools, not just signals | No actual trade execution—manual brokerage needed |

| Covers both stocks & crypto with real-time AI models | Some promises (200% return) hinge on backtesting, not real usage |

| Chatbot adds conversational support to data-driven insights | Free trial risks auto‑charge if you forget to cancel |

| Beginner-friendly, visual dashboards, great onboarding | Requires discipline—not a plug‑and‑play auto‑trader platform |

| Ability to track elite investors and hedge funds’ trades | Risk: overfitting, model failure, sentiment outlier events |

Emotional Rollercoaster + Perspective

Wanted fast wins—got cautious signals and manual trades. At first, excitement, then skepticism, a bit of frustration when swing signals lagged. But small wins from pivot trades and venturing into portfolio tracking brought cautious optimism.

It’s like hiking with a guide who gives good directions—but you still gotta walk the path. If you rely solely on the AI, you risk stepping off the cliff.

Reading user reviews: most love it, a few warn about billing traps right before the trial ends. That lack of transparency shook me. Always check cancellation terms.

Pricing & Value

Trial is 7 days free. Plans start at around $14.95/month—yearly approx $11.96/month. Adds more credibility because lower barrier to entry. For what you get—AI signals, chatbot, portfolio insights—it’s competitively priced vs more expensive bots or subscription stacks.

Who Should Use This?

- Rookies looking for guided entry into AI-powered trading.

- Swing traders wanting timed ideas in crypto and stocks.

- People who like to track top investors and sentiment events.

- Anyone who prefers decision support over fully automated trading.

Not ideal if you expect hands‑off execution or zero manual setup. Also not for high-frequency quants—it’s insight-driven, not order‑execution driven.

Suggestions for Improvement

- Transparent billing reminders before trial auto-charge.

- Broader global market coverage (currently US only)

- Mobile‑optimized dashboard (users mention responsive design issues).

- Exportable logs for deeper analysis offline.

Final Verdict: Is It The Best Review-Worthy Tool?

Intellectia.AI impressed me as a smart AI companion, not a trading autopilot. It blends signals, technical analysis, sentiment, and chat assistance into one package. It’s not perfect—and it doesn’t execute trades—but for active traders who need insights rather than automation, it delivers solid value.

If you’re willing to manually act on its guidance, keep emotional control, and double‑check every AI suggestion, it can be a game-changer. But if you expect magic bot trades while you sleep—this isn’t it.

Should You Try It?

Definitely give the 7‑day trial a shot. Use it every morning: check Stock Picker, swing signals, monitor portfolios, ask the chatbot questions, and manually place trades in small size. Keep track of performance. If you walk away more informed than when you started, it’s worth a subscription.

If you’d like help building prompt queries for the Financial AI Agent or tips to test swing signals, happy to walk through it.