Netflix Statistics 2025: Subscribers, Revenue, Market Share & Global Reach

Netflix has become more than just a streaming service—it’s a global cultural powerhouse that shapes how millions of people around the world consume entertainment.

From its humble beginnings mailing DVDs in the late 1990s to its current status as a platform with hundreds of millions of subscribers, Netflix has transformed both the media industry and the habits of its audience.

Today, it’s not just about what shows or movies are popular, but also about how deeply Netflix has embedded itself into everyday life: how many countries it reaches, which demographics tune in the most, how many hours people spend watching, and even how its financial and market presence stack up against its competitors.

Looking at subscriber numbers, geographic reach, viewing habits, and market share gives a fuller picture of why Netflix remains at the center of the streaming revolution—and how it continues to fight for dominance in an increasingly crowded marketplace.

How many subscribers are there of Netflix?

Netflix currently has about 301.6 million paid subscribers around the world. That figure was reached by the end of 2024, after a very strong fourth quarter where Netflix added some 18.9 million new paid memberships.

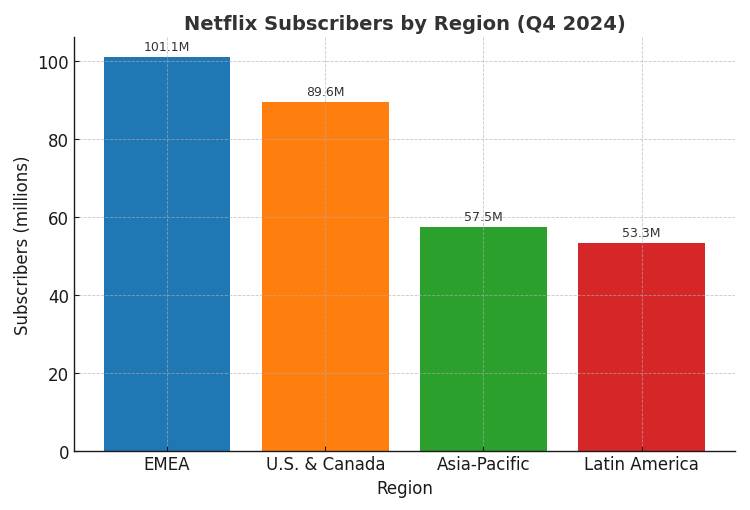

Here’s a breakdown by region as of Q4 2024:

| Region | Number of Subscribers (approx.) |

| Europe, Middle East & Africa (EMEA) | 101.1 million |

| U.S. & Canada | 89.6 million |

| Asia-Pacific | ~ 57.5 million |

| Latin America | ~ 53.3 million |

Some other interesting tidbits:

- The ad-supported (“cheapest”) plan has seen big growth. By May 2025, there were ~ 94 million subscribers on that ad tier.

- Netflix has said it will stop giving detailed quarterly breakdowns of its number of paid memberships (i.e. how many subscribers) starting from Q1 2025, instead focusing more on revenue and other metrics.

So, bottom line: Netflix is well above 300 million paid members now, with growth coming from all regions but especially from Asia-Pacific and the ad-tier signups. If you want, I can pull the very latest estimate (mid-2025) with a regional split.

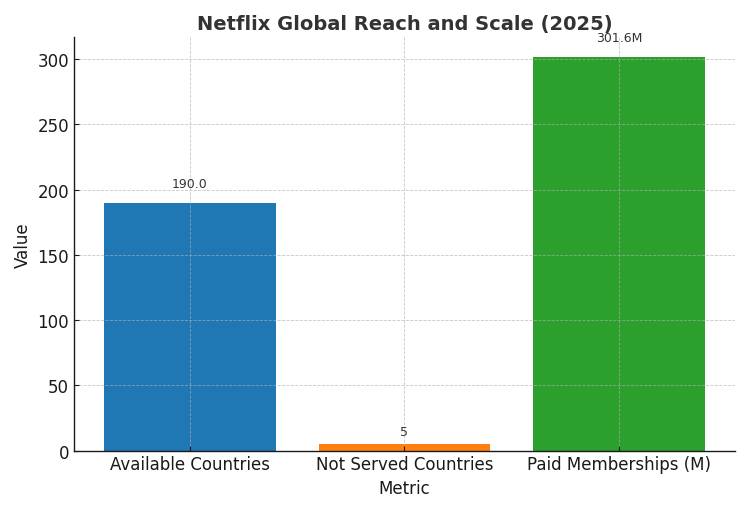

How many countries is Netflix available in 2025?

Netflix is available in over 190 countries worldwide, with a few notable exceptions. The countries where Netflix does not currently operate are China, Crimea, North Korea, Russia, and Syria.

For users in each country where it is available, the specific library of movies, TV shows, and other content varies—and the catalog changes regularly.

Here are some key numbers and comparisons to put that into perspective:

| Metric | Value |

| Number of countries where Netflix is available | Over 190 |

| Number of countries not served by Netflix | 5 |

| Total paid memberships globally (for context) | ~ 301.6 million |

Because Netflix has scaled that far, content licensing, language options (subtitles, dubbing), and even price tiers tend to vary a lot from one country to another.

So when people say Netflix is “global,” they’re mostly right—but that doesn’t mean the experience is identical everywhere. If you want, I can pull up which regions have the largest gaps in catalog or feature differences.

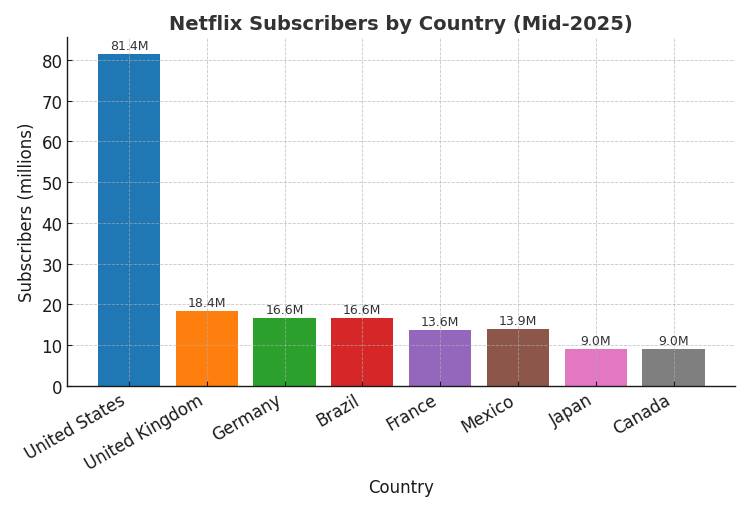

What countries have the most Netflix subscribers?

Here are some of the countries with the most Netflix subscribers as of mid-2025, plus a snapshot of how they compare. The U.S. is still king of the hill by a wide margin, followed by a few other large media markets.

| Country | Estimated Netflix Subscribers |

| United States | ~ 81.44 million |

| Brazil | ~ 16.59 million |

| Germany | ~ 16.59 million |

| United Kingdom | ~ 18.4 million |

| France | ~ 13.57 million |

Aside from the biggest markets, there are several countries where Netflix has strong penetration (i.e. a large number of subs relative to population), even if those countries don’t hit the top 5 in raw numbers.

For example, Mexico, Japan, and Canada each have millions of users (Mexico ~ 13.9 million, Japan ~ 9 million, Canada ~ 9 million) according to estimates.

It’s interesting to see that although the United States has nearly 80 million subscribers, the gap to the next few countries is pretty steep: the U.K. (~ 18.4M) is the 2nd largest single-country market, followed by Germany and Brazil.

That means more than a quarter of Netflix’s global paying audience is in the U.S. alone. The large Latin American and European markets are pulling their weight but aren’t close to matching the U.S. in absolute scale.

If you like, I can also check per-capita subscription numbers (subs per 100 people) to see where Netflix is most “popular” rather than just where it’s biggest.

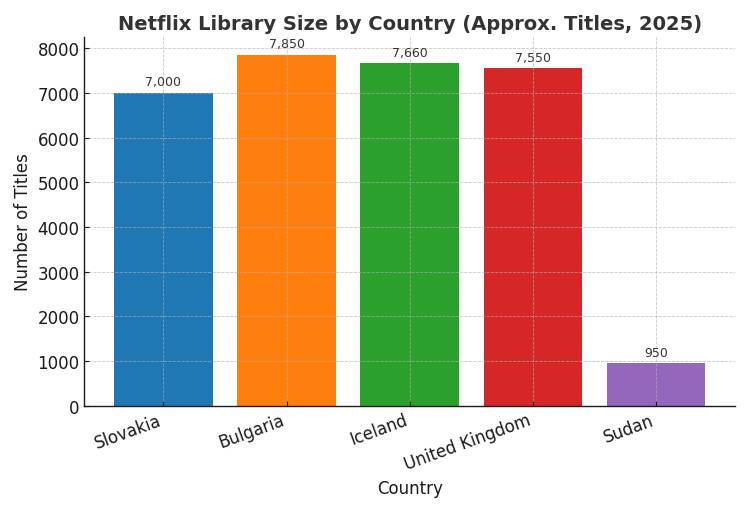

What country has the most available Netflix?

When counting how many shows and movies are available, Slovakia comes out on top among all Netflix regions. Users in Slovakia reportedly have access to over 7,000 titles—a mix of movies + TV-series—that is larger than what you find in most other countries’ Netflix libraries.

Other European countries are close behind: Bulgaria, Iceland, Estonia, the UK, Germany, Austria, etc., each have libraries in the 7,300–8,000 title range.

Here’s a table of the top few:

| Country | Approximate Number of Titles in Netflix Library |

| Slovakia | ~ 7,000+ titles |

| Bulgaria | ~ 7,700–8,000 titles |

| Iceland | ~ 7,660 titles |

| United Kingdom | ~ 7,500–7,600 titles |

On the flip side, some countries have noticeably smaller libraries. For example, Sudan is among the least, with around 900–1,000 titles available.

It’s interesting: people often assume the U.S. has the biggest library, but in several of the recent studies the U.S. isn’t first in total title count.

The U.S. library is large, sure, but some smaller markets in Europe have more titles overall because of licensing, local content, and how rights are structured.

If you want, I can try to find the very latest (2025) numbers for all countries and see if anything has changed, e.g. is Slovakia still number one.

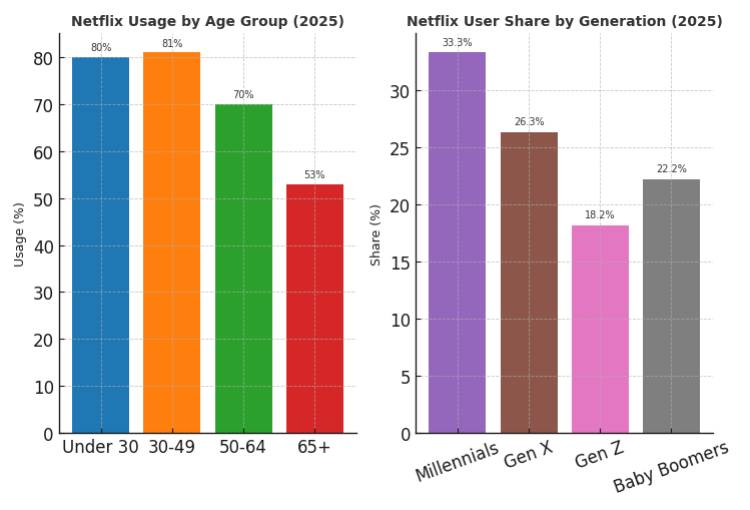

What age group uses Netflix the most?

According to a Pew Research survey from 2025, about 80% of U.S. adults under 30 use Netflix, and a similar share—81%—for those aged 30-49. That drops to 70% for people aged 50-64, and further to 53% for adults aged 65 or older.

Another source, looking at U.S. user demographics, breaks out the Netflix user base by generation:

| Age / Generation | Share of Netflix Users |

| Millennials (roughly ages ~26-41 in 2025) | ~ 33.3% |

| Generation X (~42-57) | ~ 26.3% |

| Gen Z (~18-25) | ~ 18.2% |

| Baby Boomers (older than ~57) | ~ 22.2% |

Putting that together, Millennials form the biggest single group among Netflix users, followed by Gen X and then Gen Z, with Baby Boomers trailing (but still making up a large minority).

What this suggests is that while Netflix is strongest among younger/middle-aged adults, it isn’t only them—older folks are participating substantially too, especially those aged 50-64.

Also, usage frequency tends to drop with age: younger people not only are more likely to have Netflix but are more likely to watch it often, while older age brackets are less frequent users.

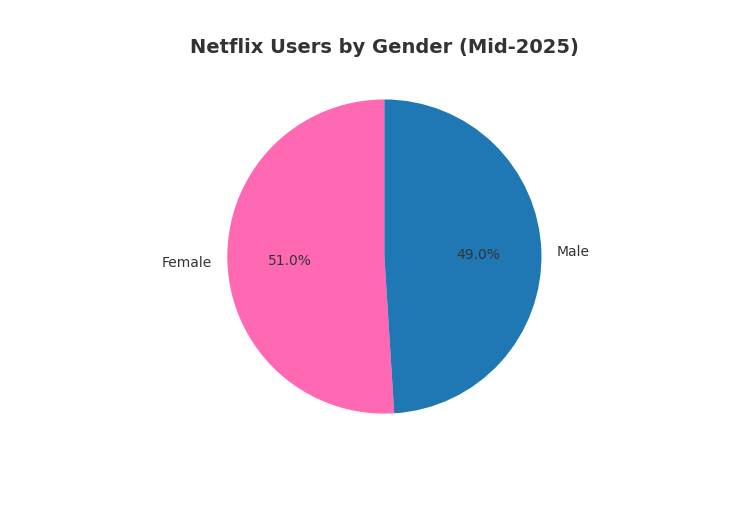

What gender uses Netflix the most?

Here’s what I found about which gender uses Netflix more — the numbers are pretty close, but there is a slight lean. As of mid-2025, about 51% of Netflix users are female and 49% are male. This gap is small — basically, Netflix viewership is almost evenly split between the two genders.

Here’s a little table to sum it up:

| Gender | Share of Netflix Users |

| Female | ~ 51% |

| Male | ~ 49% |

Although females are a small majority, it’s barely over half — so you can’t say Netflix is dominated by one gender. Another interesting point: the data doesn’t show a big variation by country in terms of gender split; it tends to stick close to this nearly even ratio in many markets.

Also, the figures seem pretty stable over time—there aren’t big swings that suggest one gender is growing much faster than the other in adoption.

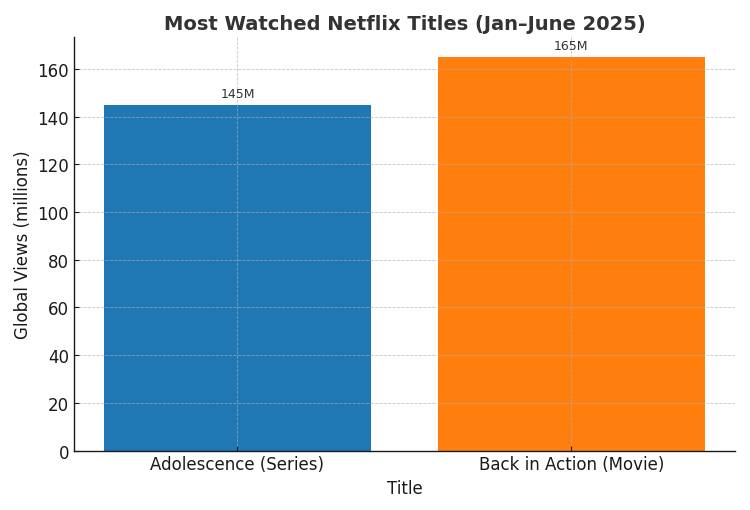

What is the most watched thing on Netflix?

The most-watched series globally during that period was Adolescence, a British four-episode crime-psychological drama. It amassed about 145 million views across Netflix viewers during Jan-June 2025. Squid Game Seasons 2 and 3 followed closely behind in the series rankings.

When it comes to movies, Back in Action was Netflix’s biggest hit in H1 2025, racking up 165 million views globally.

Other top movie performers in that same timeframe included Straw and The Life List. These aren’t necessarily new releases but they show what people are choosing to click on.

Here’s a short table summarizing:

| Type | Title | Global Views (Jan-June 2025) |

| Series | Adolescence | ~ 145 million |

| Movies | Back in Action | ~ 165 million |

Netflix also shared that in those six months, enormous amounts of hours were streamed overall—older popular shows like Ozark, Orange Is the New Black, Money Heist still pulled in big numbers, showing that catalog content continues to have staying power. (report)

It’s worth noting that “most-watched” here is based on total viewings (or similar metrics) over that six-month span, which means newer titles have an uphill battle compared to older ones just because they have less time to accumulate hours.

But Adolescence and Back in Action still rose to the top—people clearly gravitated toward them, for whatever reason, whether it was word of mouth, marketing, or just catching the right moment.

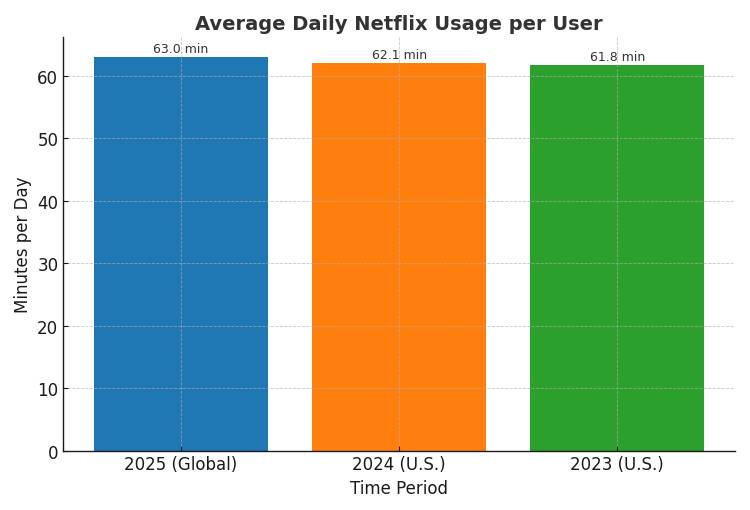

What is the average hours of Netflix usage?

Netflix users in 2025 spend about 63 minutes per day watching content on the platform. That comes from a study of average usage globally, and it includes both movies and TV shows.

Another source (focused mainly on the U.S.) agrees: Americans spent on average 1 hour and 3 minutes per day on Netflix, up slightly from ~ 62.1 minutes in 2024 and ~ 61.8 minutes in 2023.

Here’s a short table to compare:

| Time Period | Average Daily Netflix Usage per User |

| 2025 (global) | ~ 63 minutes/day |

| 2024 (U.S.) | ~ 62.1 minutes/day |

| 2023 (U.S.) | ~ 61.8 minutes/day |

There are older reports suggesting higher usage, especially during lockdown periods—e.g. in certain previous years Netflix claimed average daily watch times closer to two hours per user.

But the most reliable and recent data points are much closer to that one-hour-a-day mark.

So, the bottom line is: people are watching Netflix roughly one hour a day, on average.

That might vary a lot by country, age group, subscription type (ad-supported vs premium), or how many profiles are used under one account, but that number gives a good ballpark.

Is Netflix the largest streaming service?

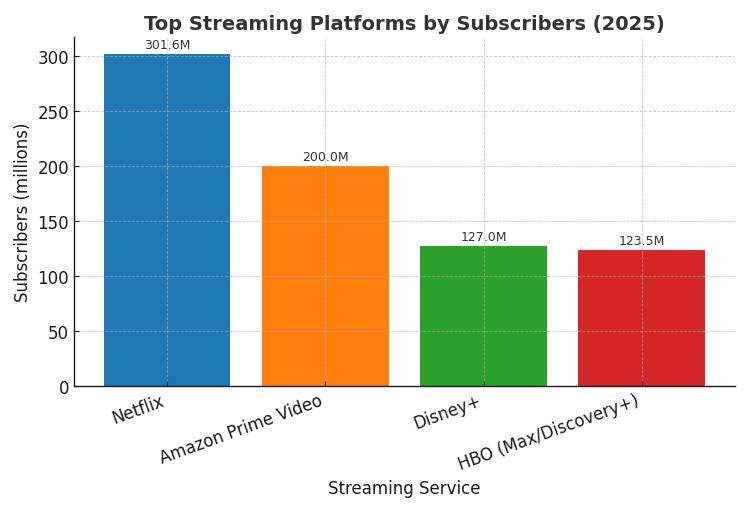

Netflix is widely regarded as the largest subscription video-on-demand (SVOD) streaming service globally when you stack up subscriber counts, though competition is fierce and metrics can vary depending on how you define “largest.”

As of 2025, Netflix has about 301.6 million paid subscribers worldwide, putting it in first place among streaming platforms. For comparison, Amazon Prime Video is in second with around 200 million, and Disney+ follows with roughly 126–128 million paid subs.

Here’s a comparison table of top streaming platforms by subscriber count:

| Streaming Service | Approximate Number of Paid Subscribers (2025) |

| Netflix | ~ 301.6 million |

| Amazon Prime Video | ~ 200 million |

| Disney+ | ~ 126-128 million |

| HBO (Max/Discovery+) | ~ 122-125 million |

Beyond sheer subscribers, Netflix often leads in other indicators: it operates in more than 190 countries, has a large content library, and tends to dominate in terms of daily usage and hours watched (in markets it serves).

That said, “largest” can mean different things: some competitors might lead in specific regions, content niches, or revenue per user. Plus, metrics like active users vs paid memberships, or inclusion of ad-supported tiers all complicate direct comparisons.

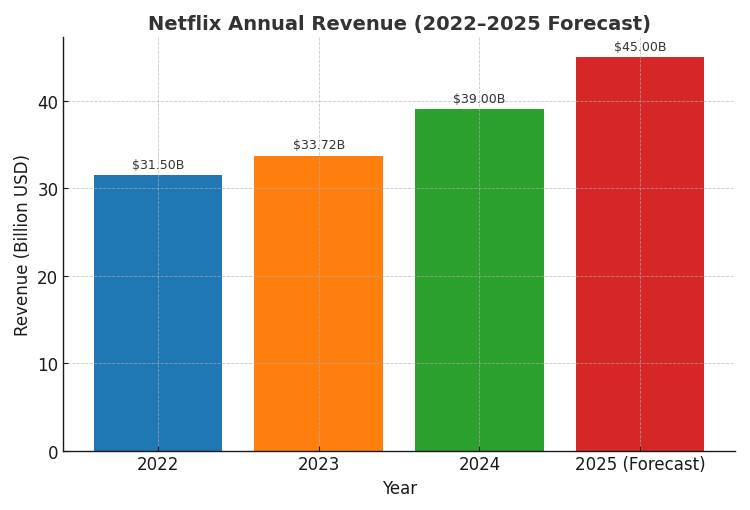

What is the annual revenue of Netflix?

In 2024, Netflix generated about US$39.00 billion in revenue, up roughly 15–16% compared to 2023.

For reference, in 2023 their revenue was approximately US$33.72 billion, which itself was an increase over 2022.

Here’s a table summarizing recent years:

| Year | Annual Revenue (USD) | Year-over-Year Growth |

| 2022 | (lower, ~US$31-32B) | — |

| 2023 | ~ US$33.72B | ~ 6.6% over 2022 |

| 2024 | ~ US$39.00B | ~ 15.7% over 2023 |

Looking ahead, Netflix projects continued revenue growth in 2025. Forecasts and guidance from the company and analysts expect 2025 revenues to land somewhere between US$44.8 billion to US$45.2 billion, driven by factors like price increases, membership growth (especially from ad-supported tiers), and higher average revenue per user.

Some additional context: in 2024, North America remained Netflix’s largest single regional contributor in revenue.

Also, Netflix has been investing heavily in its content library (originals + licensing), as well as exploring ad-supported models and live or event‐based programming to diversify its revenue sources.

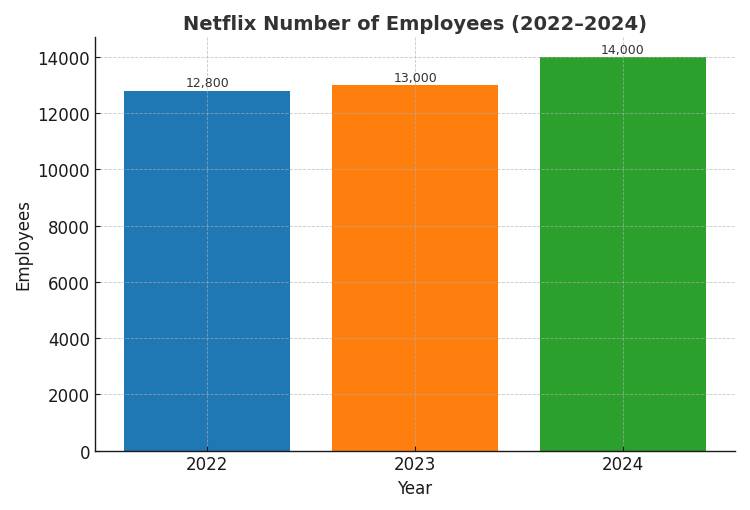

How many employees does Netflix have?

Netflix had about 14,000 full-time employees worldwide as of December 31, 2024. This was up by ~1,000 employees (≈ 7.7%) compared to the prior year, when it had around 13,000 staff.

Here’s how it’s grown over recent years:

| Year | Number of Employees | Year-over-Year Change |

| 2024 | ~ 14,000 | +1,000 (≈ 7.7%) over 2023 |

| 2023 | ~ 13,000 | +200 (≈ 1.6%) over 2022 |

| 2022 | ~ 12,800 | increase over 2021 |

Some additional context: the employee growth tends to reflect Netflix’s expanding operations—more original content production, more global reach, greater tech/platform work, and now more efforts in ad-supported subscription tiers etc.

Because companies sometimes report “full-time equivalent” vs “full-time” or include/exclude contractors, the numbers can vary slightly depending on source. But the consensus is that 14,000 is the figure for end-2024.

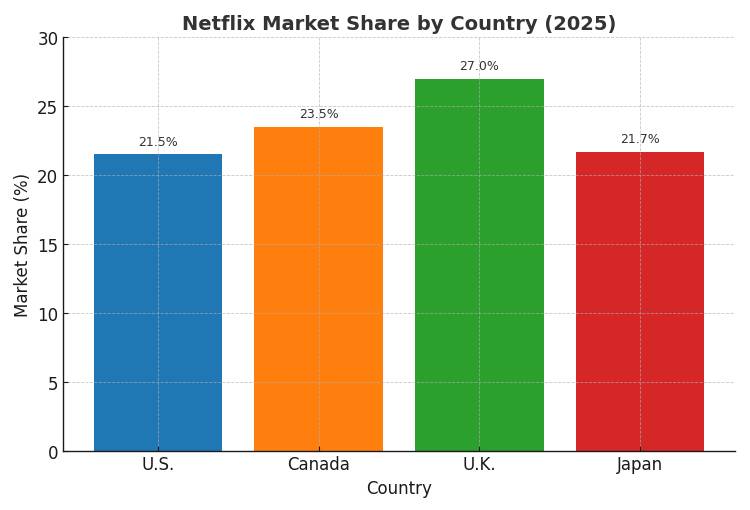

What is Netflix’s current market share?

In the U.S. streaming market, Netflix has around 21–22% market share. It’s basically tied with Amazon Prime Video, which also commands roughly 22%. Other big players lag behind: Max, Disney+, Hulu, and others have smaller slices.

Here are numbers for a few other countries:

| Country | Netflix Market Share |

| Canada | ~ 23-24% |

| United Kingdom | ~ 27% |

| Japan | ~ 21.7% |

Globally, Netflix is still the most subscribed subscription video-on-demand (SVOD) service, with about 301.6 million paid subscribers. That gives it a strong base compared to many rivals.

It’s also useful to consider viewing share / watch time metrics. In June 2025 in the U.S., Netflix grabbed 8.3% of total TV viewing time—that means out of all the time people spend watching TV (including broadcast, cable, streaming, etc.), Netflix alone was responsible for 8.3%. It also contributed about 42% of the monthly growth in streaming viewership in that month.

Putting it all together: Netflix doesn’t dominate everything but it has a major presence. In terms of paying subscribers it’s often first or near-first globally, in many markets; but in usage share or viewing time it has big competition.

If you want, I can pull up a chart showing how its market share has shifted over the past 5 years, so you can see whether its lead is growing or shrinking.

Taking all the numbers and stories together, one thing is crystal clear: Netflix is still the heavyweight of the streaming world, but the battle for attention has never been tougher.

With more than 300 million subscribers, availability in nearly every country on the map, and daily viewing time that averages about an hour per person, Netflix continues to hold a commanding spot in people’s routines.

At the same time, rivals like Disney+, Amazon Prime Video, and Max are chipping away at market share, while newer trends like ad-supported tiers and global licensing challenges are reshaping how success is measured.

Still, whether it’s the most-watched series of the year, a record-breaking movie launch, or the raw scale of its revenue and workforce, Netflix manages to stay in the headlines and in the living rooms of audiences worldwide.

Its story isn’t one of unchallenged dominance anymore—it’s a tale of adaptation, resilience, and relentless competition. And that’s what makes watching Netflix itself almost as interesting as watching what’s on Netflix.